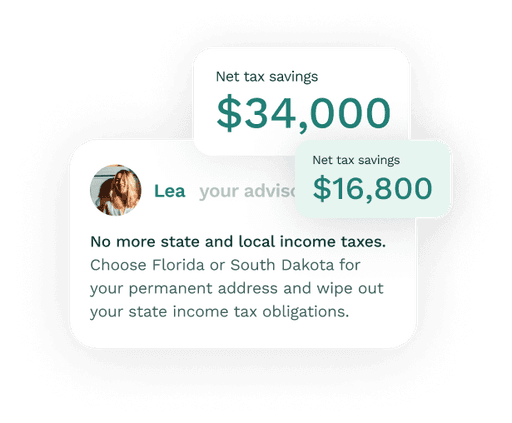

Maximize your savings and flexibility with Florida domicile

No state income tax

Significant savings from no state income tax on various income sources including employment, pensions, dividends, and interest

No capital gains tax

Benefit from the absence of capital gains tax, improving how much you benefit from your investments

Simple residency

Florida's domicile requirements provide flexibility and convenience for digital nomads

No estate tax

Benefit from Florida’s lack of estate tax, enhancing your wealth preservation and legacy planning