Cut your state income tax

with Florida residency

We help you set up a Florida residential address, get DMV-ready paperwork, and stay on track with a guided residency dashboard built for expats.

Cut your state income tax

with Florida residency

We help you set up a Florida residential address, get DMV-ready paperwork, and stay on track with a guided residency dashboard built for expats.

Cut your state income tax

with Florida residency

We help you set up a Florida residential address, get DMV-ready paperwork, and stay on track with a guided residency dashboard built for expats.

SavvyNomad provides general educational information and document-preparation support. We’re not a law firm, tax advisor, financial advisor, or government agency. Outcomes, timelines, and potential tax savings depend on individual circumstances and third-party decisions; no outcome is guaranteed.

Maximize your savings and flexibility with Florida domicile

No state income tax

Potential savings from Florida's absence of a state income tax on various types of income (actual savings will depend on your situation and previous state).

No capital gains tax

Florida doesn’t impose a separate state tax on capital gains. Federal capital-gains rules and laws in other states can still apply.

Simple residency

Florida’s domicile can be more flexible than some high-tax states, which may suit expats and nomads when combined with the right tax advice.

Estimated estate tax savings

Florida has no separate state estate tax, which may support wealth-preservation strategies. However, federal estate-tax rules and future laws could still impact you.

No state income tax

Significant savings from no state income tax on various income sources including employment, pensions, dividends, and interest

No capital gains tax

Benefit from the absence of capital gains tax, improving how much you benefit from your investments

Simple residency

Florida's domicile requirements provide flexibility and convenience for digital nomads

Estimated estate tax savings

Benefit from Florida’s lack of estate tax, enhancing your wealth preservation and legacy planning

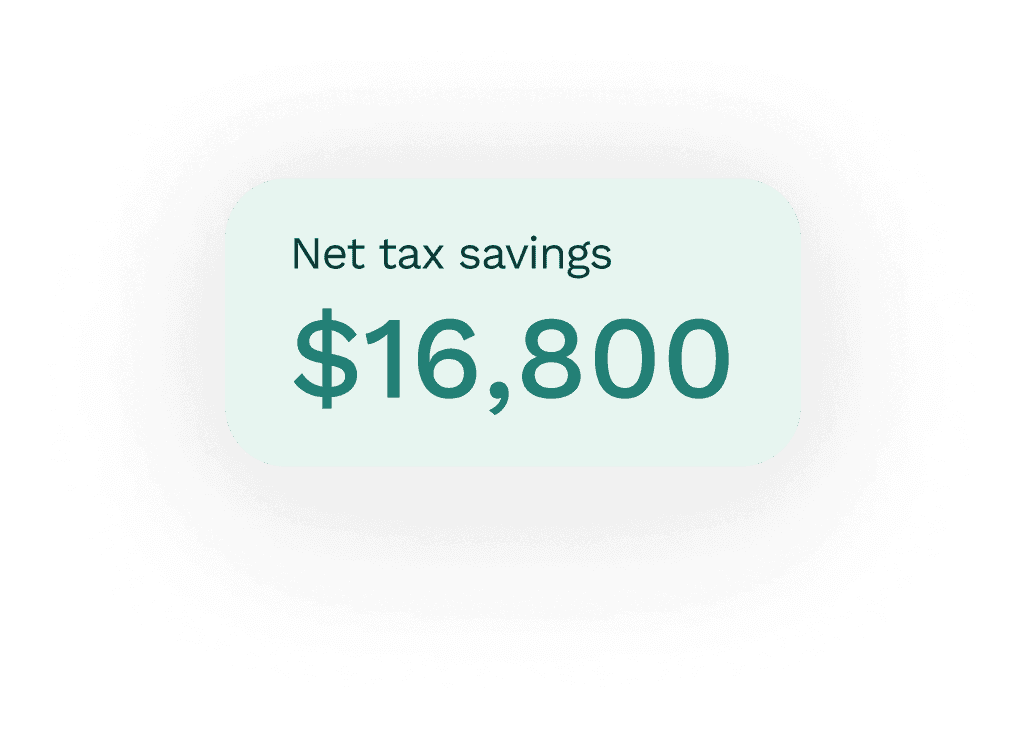

See how much you could save on state income tax with a Florida domicile

*State-level illustration only; city/local taxes not included. Estimates are for education, not guarantees or legal/tax advice..

Which address do you need?

Mail Address

Basic Residential Address

Premium Address

Suitable for banking and legal purposes

No

Yes

Yes (including strict institutions like Robinhood)

Suitable for a driver’s license

No

Yes

Yes

Accepted by financial institutions

No

Often accepted; some services (e.g., Robinhood, Mercury) may not.

Designed for stricter services and used with Robinhood/Mercury; approval varies by institution.

Suitable for banking and legal purposes

No

Yes (with residency letter)

Yes (with utility bill)

Lease agreement provided

No

No

Yes (add-on)

Utility bill provided

No

No

Yes

Broad range of ACA-compliant options

No

Included

Included (high-priority, personalized support)

Suitable for mail & package forwarding

Yes

No, only essential mail

Included

Business address & mail forwarding included

No

No

Included

Regular Mailboxes

Basic Residential Address

Premium Address

Suitable for banking and legal purposes

No

Yes

Yes (including strict institutions like Robinhood)

Suitable for a driver’s license

No

Yes

Yes

Accepted by financial institutions

No

Often accepted; some services (e.g., Robinhood, Mercury) may not.

Designed for stricter services and used with Robinhood/Mercury; approval varies by institution.

Suitable for banking and legal purposes

No

Yes (with residency letter)

Yes (utility bill)

Lease agreement provided

No

No

Yes (add-on)

Utility bill provided

No

No

Yes

Broad range of ACA-compliant options

No

Included

Included (high-priority, personalized support)

Suitable for mail & package forwarding

Yes

No, only essential mail

Included

Business address & mail forwarding included

No

No

Included

References to specific institutions (including Robinhood and Mercury) are based on past experience and are not guarantees. Each bank, broker, or agency decides whether to accept an address and may change its policies at any time.

Clear steps, quick turnaround, human help when you need it

Step 1

Step 1

Secure a Florida address

Secure a Florida address

We set you up with a livable Florida residential address plus proofs you can use when banks, ID providers, or agencies request one. Final acceptance depends on each institution.

We set you up with a livable Florida residential address plus proofs you can use when banks, ID providers, or agencies request one. Final acceptance depends on each institution.

Step 2

Step 2

Step 2

Obtain a Florida driver’s license

Obtain a Florida driver’s license

Sign up 30–60 days before your Florida trip so we can prep documents and any needed appointments. You visit the DMV with ID, SSN, and two proofs of address; we help provide the address proofs.

Sign up 30–60 days before your Florida trip so we can prep documents and any needed appointments. You visit the DMV with ID, SSN, and two proofs of address; we help provide the address proofs.

Step 3

Step 3

Register your vehicles in Florida

Register your vehicles in Florida

If you own a vehicle, registering it in Florida can help show ties to the state. We guide typical steps and VIN options; DMVs make the final call on what’s required.

If you own a vehicle, registering it in Florida can help show ties to the state. We guide typical steps and VIN options; DMVs make the final call on what’s required.

Step 4

Step 4

File a declaration of domicile

File a declaration of domicile

File a declaration of domicile

We prepare and file your declaration of domicile with the Clerk of Court and pass through state filing fees, so you don’t have to manage the process yourself.

We prepare and file your declaration of domicile with the Clerk of Court and pass through state filing fees, so you don’t have to manage the process yourself.

Step 5

Step 5

Step 5

Voter registration

Voter registration

If eligible, you may register to vote. It’s a supporting indicator of domicile—not determinative on its own. For eligibility, consult Florida election officials.

If eligible, you may register to vote. It’s a supporting indicator of domicile—not determinative on its own. For eligibility, consult Florida election officials.

Step 6

Step 6

Update financial accounts

Update financial accounts

Update banks, brokerages, payroll, insurance, and key subscriptions to your Florida address. We provide you with the exact address format to minimize common rejections, although each institution has its own decision.

Update banks, brokerages, payroll, insurance, and key subscriptions to your Florida address. We provide you with the exact address format to minimize common rejections, although each institution has its own decision.

Step 7

Maintain Florida as your primary residence

Keep Florida as your home base in third-party and official records: use your FL address on tax returns and W-2/1099s, keep your FL driver’s license current, vote in Florida, keep Florida insurance/banking, and avoid creating competing ties in other states.

Step 7

Maintain Florida as your primary residence

Keep Florida as your primary residence in official records, where appropriate. Maintain your FL ID and insurance/banking, and avoid building competing long-term ties in other states. Consult with a qualified tax advisor to discuss your situation.

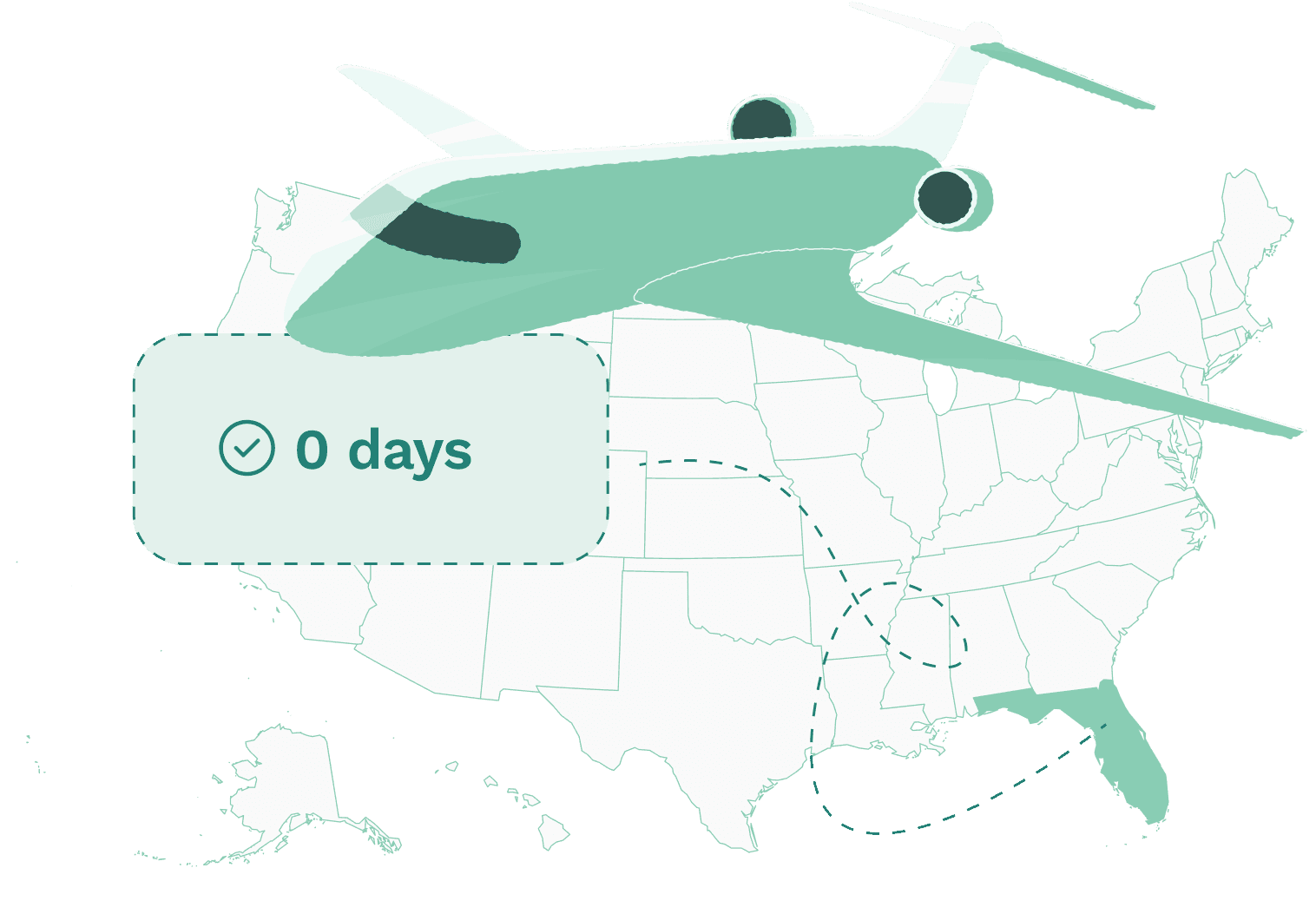

No minimum stay requirement

Florida doesn’t set a specific minimum-day requirement for domicile. What matters is completing key steps and maintaining strong ties in Florida; your former state may still have its own day-count rules.

No minimum stay requirement

Florida doesn’t set a specific minimum-day requirement for domicile. What matters is completing key steps and maintaining strong ties in Florida; your former state may still have its own day-count rules.

No minimum stay requirement

Florida doesn’t set a specific minimum-day requirement for domicile. What matters is completing key steps and maintaining strong ties in Florida; your former state may still have its own day-count rules.

Florida vs South Dakota vs Nevada

Florida

South Dakota

Nevada

Tax

State Income Tax

0%

0%

0%

Capital Gain Tax

0%

0%

0%

Estate Tax

0%

0%

0%

Sales Tax

6%

4.5%

6.85% – 8.85%

Payroll Taxes

No problems

Cannot use address for unemployment taxes

No problems

Establishing Residency (minimum requirements)

Local address

Driver’s license

Minimum stay

No explicit minimum stay duration

24 hours every 5 years

1 month

Access to International Airports

Access

Extensive options

Limited access

Extensive options, including LAX

Geographical Considerations

Better for travel to

East Coast / Europe / LatAm

West Coast

Mexico, Central America, West Coast

Health Insurance

Options

Broad range of ACA-compliant options

Limited ACA-compliant options

Broad range of ACA-compliant options

Car

Registration

Vehicle must be brought to Florida or VIN verified locally by law enforcement officer

Online

Vehicle must be in state for smog check (for most counties)

Florida

South Dakota

Nevada

Tax

State Income Tax

0%

0%

0%

Capital Gain Tax

0%

0%

0%

Estate Tax

0%

0%

0%

Sales Tax

6%

4.5%

6.85% – 8.85%

Payroll Taxes

No problems

Cannot use address for unemployment taxes

No problems

Establishing Residency (minimum requirements)

Local address

Driver’s license

Minimum stay

No explicit minimum stay duration

24 hours every 5 years

1 month

Access to International Airports

Access

Extensive options

Limited access

Extensive options, including LAX

Geographical Considerations

Better for travel to

East Coast / Europe / LatAm

West Coast

Mexico, Central America, West Coast

Health Insurance

Options

Broad range of ACA-compliant options

Limited ACA-compliant options

Broad range of ACA-compliant options

Car

Registration

Vehicle must be brought to Florida or VIN verified locally by law enforcement officer

Online

Vehicle must be in state for smog check (for most counties)

Florida

South Dakota

Nevada

Tax

State Income Tax

0%

0%

0%

Capital Gain Tax

0%

0%

0%

Estate Tax

0%

0%

0%

Sales Tax

6%

4.5%

6.85% - 8.85%

Payroll Taxes

No problems

Cannot use address for unemployment taxes

No problems

Establishing Residency (minimum requirements)

Local address

Driver’s license

Minimum stay

No explicit minimum stay duration

24 hours every 5 years

1 month

Access to International Airports

Access

Extensive options

Limited access

Extensive options, including LAX

Geographical Considerations

Better for travel to

East Coast / Europe / LatAm

West Coast

Mexico, Central America, West Coast

Health Insurance

Options

Broad range of ACA-compliant options

Limited ACA-compliant options

Broad range of ACA-compliant options

Car

Registration

Vehicle must be brought to Florida or VIN verified locally by law enforcement officer

Online

Vehicle must be in state for smog check (for most counties)

Tax rates, residency rules, and registration requirements are summarized and may change. This table is for general educational comparison only and isn’t legal or tax advice; always confirm current rules with official state sources and a qualified tax professional.

Let Florida’s 0% state tax work for you

Fast address setup, DMV-ready paperwork, and clear steps in a simple dashboard with responsive human help.

Let Florida’s 0% state tax work for you

Fast address setup, DMV-ready paperwork, and clear steps in a simple dashboard with responsive human help.

Let Florida’s 0% state tax work for you

Fast address setup, DMV-ready paperwork, and clear steps in a simple dashboard with responsive human help.

Let Florida’s 0% state tax work for you

Fast address setup, DMV-ready paperwork, and clear steps in a simple dashboard with responsive human help.

Customer stories

FAQ

FAQ

Are there any upfront fees or additional charges beyond the monthly service fee?

What if I am not a full-time digital nomad? Can I still use SavvyNomad?

Which income tax-free state will I domicile in?

Do I need to live in Florida to use SavvyNomad?

Do I still qualify if I own property or a home within the US?

What if I am summoned for jury duty while out of state?

What happens to my mail?

I used to be a digital nomad, but no longer. Can I still use SavvyNomad?

Do I need to drive my vehicle to my new domicile state in order to register it in person?

Do I need to be out of the country for 6 months every year to qualify?

How many days per year do I need to spend in a zero-income tax state?

Does SavvyNomad work even if I only stay within the USA all year?

Does SavvyNomad have any certifications?

Does SavvyNomad apply to California or New York residents?

Address

The United States

1111 Oakfield Dr., Ste. 115E

Brandon

FL 33511

SavvyNomad provides general information for educational purposes and document-preparation support. We’re not a law firm, tax advisor, financial advisor, or government agency, and we don’t provide legal, tax, or investment advice. Outcomes, timelines, and potential cost or tax savings vary by individual situation and third-party processing; no outcome is guaranteed and testimonials reflect individual experiences only. Services, pricing, and availability may change, and additional government or third-party fees may apply. Eligibility depends on jurisdiction-specific rules.

© 2025 SavvyNomad. All rights reserved.

Address

The United States

1111 Oakfield Dr., Ste. 115E

Brandon

FL 33511

SavvyNomad provides general information for educational purposes and document-preparation support. We’re not a law firm, tax advisor, financial advisor, or government agency, and we don’t provide legal, tax, or investment advice. Outcomes, timelines, and potential cost or tax savings vary by individual situation and third-party processing; no outcome is guaranteed and testimonials reflect individual experiences only. Services, pricing, and availability may change, and additional government or third-party fees may apply. Eligibility depends on jurisdiction-specific rules.

© 2025 SavvyNomad. All rights reserved.

Which address do you need?

Regular Mailboxes

Basic Residential Address

Premium Address

Suitable for banking and legal purposes

No

Yes

Yes (including strict institutions like Robinhood)

Suitable for a driver’s license

No

Yes

Yes

Accepted by financial institutions

No

Often accepted; some services (e.g., Robinhood, Mercury) may not.

Designed for stricter services and used with Robinhood/Mercury; approval varies by institution.

Suitable for banking and legal purposes

No

Yes (with residency letter)

Yes (utility bill)

Lease agreement provided

No

No

Yes (add-on)

Utility bill provided

No

No

Yes

Broad range of ACA-compliant options

No

Included

Included (high-priority, personalized support)

Suitable for mail & package forwarding

Yes

No, only essential mail

Included

Business address & mail forwarding included

No

No

Included

Regular Mailboxes

Basic Residential Address

Premium Address

Suitable for banking and legal purposes

No

Yes

Yes (including strict institutions like Robinhood)

Suitable for a driver’s license

No

Yes

Yes

Accepted by financial institutions

No

Often accepted; some services (e.g., Robinhood, Mercury) may not.

Designed for stricter services and used with Robinhood/Mercury; approval varies by institution.

Suitable for banking and legal purposes

No

Yes (with residency letter)

Yes (utility bill)

Lease agreement provided

No

No

Yes (add-on)

Utility bill provided

No

No

Yes

Broad range of ACA-compliant options

No

Included

Included (high-priority, personalized support)

Suitable for mail & package forwarding

Yes

No, only essential mail

Included

Business address & mail forwarding included

No

No

Included

References to specific institutions (including Robinhood and Mercury) are based on past experience and are not guarantees. Each bank, broker, or agency decides whether to accept an address and may change its policies at any time.